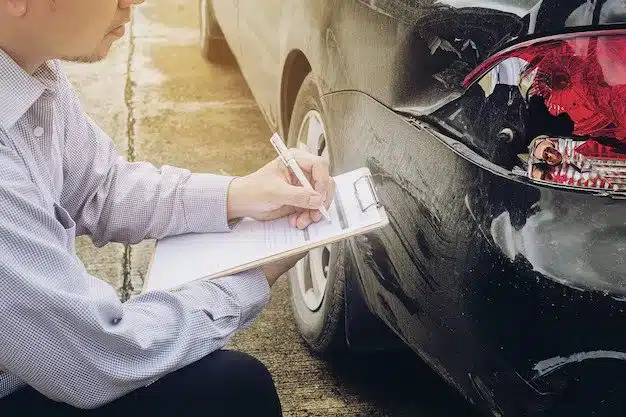

Accidents occurring on private property can lead to a complex insurance claims process. Whether you’ve experienced a slip and fall, property damage, or any other unfortunate incident, understanding the ins and outs of accident on private property insurance claims is crucial. In this article, we’ll provide you with comprehensive information on navigating this process, ensuring your rights are protected, and maximizing your compensation.

1. Defining Accident On Private Property Insurance Claims

Accident on private property refers to any unfortunate event that occurs within the confines of privately-owned premises. These incidents often require individuals to file insurance claims to seek compensation for injuries, damages, or other losses incurred.

2. Initial Steps To Take After An Accident

After an accident on private property, certain immediate actions can significantly impact the outcome of your insurance claim. These include:

- Seeking medical attention promptly and documenting injuries.

- Gathering evidence such as photographs, videos, and witness statements.

- Reporting the incident to the property owner and obtaining relevant contact information.

3. Contacting Your Insurance Provider

In accident on private property cases, it is essential to notify your insurance provider promptly. They will guide you through the claims process and explain the coverage available under your policy. Ensure you provide accurate and detailed information about the accident and any resulting injuries or damages.

4. Understanding Policy Coverage And Limitations

To maximize your compensation, familiarize yourself with the coverage and limitations of your insurance policy. This includes examining the terms related to personal injury, property damage, liability, and any exclusions that may affect your claim.

5. Building A Strong Insurance Claim

To strengthen your accident on private property insurance claim, follow these guidelines:

- Organize and document all relevant evidence, including medical records, repair estimates, and receipts for expenses.

- Maintain a detailed record of the impact the accident has had on your daily life, such as medical treatments, missed work, and emotional distress.

- Seek expert opinions or testimonies when necessary to support your claim.

6. Working With Legal Professionals

If your insurance claim becomes complicated or is denied, it may be beneficial to consult a legal professional who specializes in personal injury or insurance law. They can offer guidance, negotiate with insurance companies on your behalf, and, if needed, pursue legal action to protect your rights and maximize your compensation.

7. Resolving Disputes And Achieving Fair Settlements

In cases where disputes arise during the insurance claims process, alternative dispute resolution methods like mediation can help reach fair settlements. If a resolution cannot be reached, filing a lawsuit and going through the litigation process may be necessary to secure the compensation you deserve.

Conclusion

Accidents on private property can have significant consequences, both physically and financially. By understanding the process of accident on private property insurance claims and taking the appropriate steps, you can protect your rights and maximize your compensation. Remember to gather evidence, communicate effectively with your insurance provider, and seek professional assistance when needed. With thorough preparation and a comprehensive understanding of your rights, you can navigate the complex insurance claims process with confidence.

Also Read : The Ultimate Guide To Cost Property Insurance: Affordable Protection For Your Valuable Assets

Source Image : freepik.com